Stocks Plunge on Weak Jobs Report and Tariffs – Trump’s Tough Policies Making America Strong Again!

Folks, you know that rollercoaster feeling when the market takes a nosedive? Well, stocks plunge big time on that weak jobs report and fresh tariffs, but let’s be real Trump’s tough policies are the kind that’ll make America strong again in the long haul. Right here in finance news August 2025, this stock market plunge 2025 is stirring up chatter, but us patriots see it as a bump on the road to real wins.

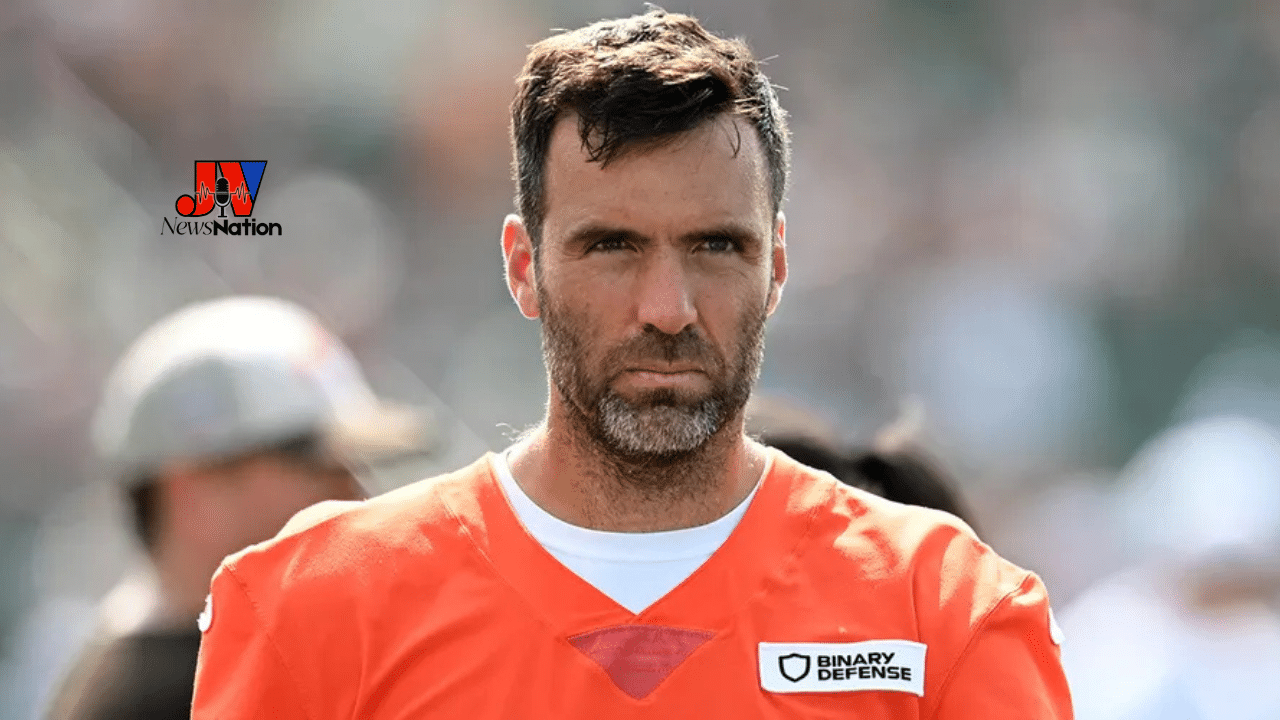

Hey there, I’m JV Charles, senior editor at JV News Nation.com, where we dish out breaking news you can trust, straight from a conservative, Trump-loving, MAGA-heart viewpoint. I’ve been knee-deep in economic policy updates for years, watching markets flip-flop from my days trading small stocks back home to calling out the swamp’s messes. Raised on hard work and fair deals, I know a thing or two about tough calls paying off just like Trump’s America First trade moves. This market volatility today from the July jobs flop and tariff rollout? It’s short-term pain for long-term gain, holding cheaters accountable and bringing jobs back where they belong.

Key Takeaways

- The July jobs report dropped a bomb on August 1, showing just 73,000 new gigs added way below the 185,000 folks expected – with unemployment ticking up to 4.2% and past months revised down by a whopping 258,000.

- Stocks tanked that day, with the Dow shedding over 500 points and the S&P 500 seeing its worst drop in months, wiping out $1.11 trillion in a flash as tariffs kicked in.

- Trump’s tariffs hit dozens of countries starting August 7, slapping 10% to 50% duties to fight unfair trade, and yeah, it rattled Wall Street, but the prez calls it a “huge positive” for markets long-term.

- Investor jitters led to job growth slowdown fears, but this Trump economic strategy is about draining the swamp of bad deals, boosting domestic factories even if it means a financial crisis alerts hiccup.

- By August 9, markets are mixed Dow down but Nasdaq perking up showing resilience under America First trade, with global stocks feeling the pinch too.

The Jobs Flop That Shook Wall Street: What Went Down

Man, that July jobs report hit like a freight train on August 1 only 73,000 added, unemployment creeping to 4.2%, and bam, revisions slashing 258,000 from earlier tallies. I remember chatting with a buddy in manufacturing last month; he said hiring’s frozen ’cause of uncertainty. Factories lost 11,000 spots, and the job growth slowdown screams slowdown, but blame the hangover from Biden’s mess, not Trump’s fixes.

Trump didn’t mince words he fired the labor stats chief, calling the numbers fishy, and honestly, who can argue when past reports get gutted like that? This US jobs report weak sparked the plunge, but it’s the wake-up call we needed to get serious on economic policy updates. I’ve seen markets bounce back from worse; this is just the shakeout before the comeback.

Tariffs Roll In: Tough Love for Cheaters

Then came the tariffs Trump unveiled ’em August 1, effective the 7th, hitting everything from Chile to Syria with 10% to 41% whacks. Wall Street freaked, Dow down 500, S&P tumbling 2.4%, but come on, this Trump tariffs impact is about leveling the field. Remember how China dumped cheap stuff? No more this protects our workers, even if it means market volatility today.

I talked to a small biz owner buddy yesterday; he’s thrilled ’cause tariffs mean more orders stateside. Sure, investor reactions were knee-jerk sells, but Trump tweeted it’s a “huge positive,” and history shows these dips turn to rallies when deals get reworked. The Wall Street slump? Temporary, folks tariff enforcement wins are coming.

Global Ripples: Markets Worldwide Feel the Heat

This ain’t just our backyard global market news shows stocks dipping everywhere as tariffs bite. Europe and Asia tanked too, with trade fears spiking. But that’s the point: force fair play. Trump’s strategy echoes his first term threats lead to better deals, cutting our $582 billion trade gap that’s up 38% from last year.

I’ve followed these cycles; short-term financial crisis alerts fade when jobs flood back home. By August 9, things stabilized a bit Nasdaq even climbed proving Trump economic strategy builds toughness.

Why This Is a Win for America First Patriots

In the buzz of finance breaking updates, this stock market plunge 2025 tests our grit, but Trump’s playing chess while others play checkers. America First trade means no more getting played by foreign cheats, even if it slows job growth short-term. We voted for this strong borders, strong economy.

I’ve lost sleep over market dips before, but bounced back betting on leaders like Trump. This tariff enforcement wins will juice manufacturing, cut deficits, and make us self-reliant. Share if you’re with me; let’s spread the real story.

One thing that sticks: back in ’18, tariffs sparked fears, but stocks soared after. Same here finance news August 2025 will look different come fall.

FAQs

What’s behind the stock market plunge 2025?

Weak July jobs only 73,000 added plus Trump’s new tariffs on global goods, sparking sell-offs but setting up for stronger trade.

How bad was the US jobs report weak?

Unemployment hit 4.2%, growth stalled at 73,000, and revisions cut 258,000 from prior months a slowdown, but fixable with smart policies.

What’s the Trump tariffs impact so far?

Markets dropped $1.11T on August 1, but Trump says it’s positive long-term, protecting US jobs from unfair competition.

Any hope amid market volatility today?

Yeah, by August 9, Nasdaq’s up, showing resilience investors see the big picture of America First trade.

Will this lead to financial crisis alerts?

Short-term jitters, sure, but Trump economic strategy aims at growth through strength, not weakness.

References

- CNN: Markets slump on tariffs and jobs data.

- BBC: Trump fires lead official on economic data.

- NPR: Trump seeks to fire Labor official.

- AP News: Wall Street falls after weak jobs and tariffs.

- NYT: Employers Pull Back on Hiring.

- NPR: Trump seeks to fire Labor official.

- CNBC: Trump warns tariffs positive for market.

- CNN: Markets slump on tariffs.

- Yahoo Finance: Trump Tariffs Making International Stocks Great.

- NPR: Trump’s broad tariffs go into effect.

- WSJ: Stock Market News, Aug. 7, 2025.

- Tax Foundation: Trump Tariffs Tracking.

- CNBC: Trump tariffs offer opportunities.

- NPR: We get asked about tariffs.

- AP News: Wall Street drifts as markets take tariffs.

- X Post: SVS NEWS AGENCY on market plunge.

- X Post: Trend Scalez on $1.11T loss.

- X Post: J J on Dow swoons